CA SFL-461 2020-2024 free printable template

Show details

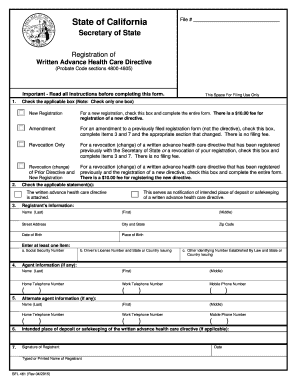

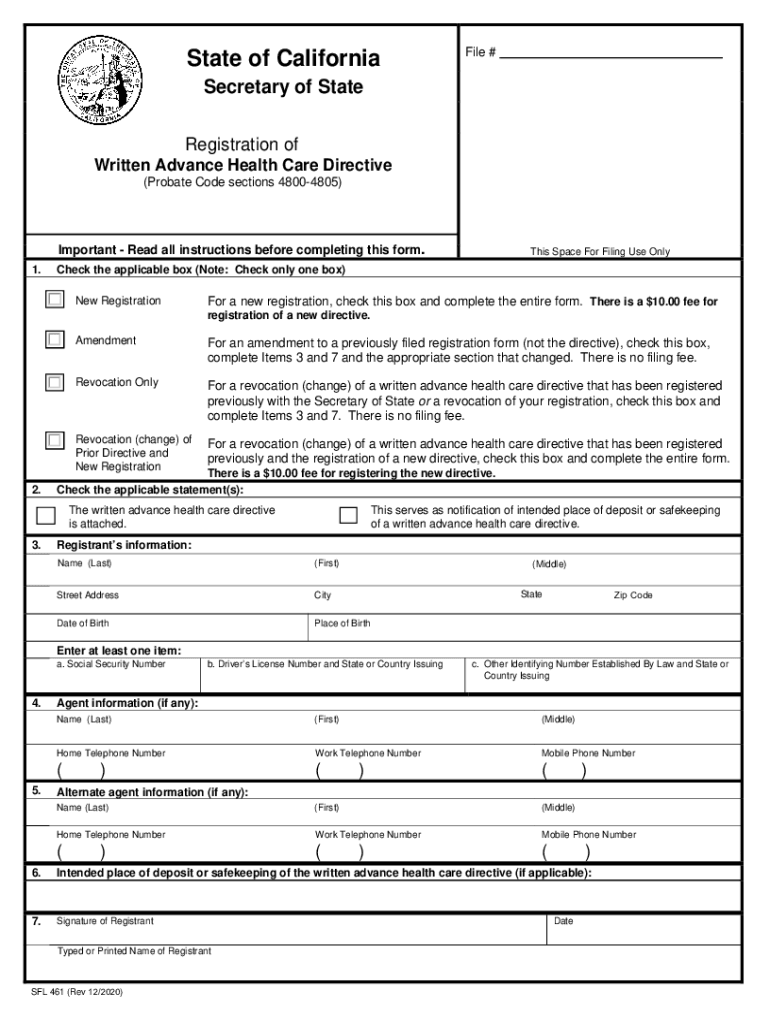

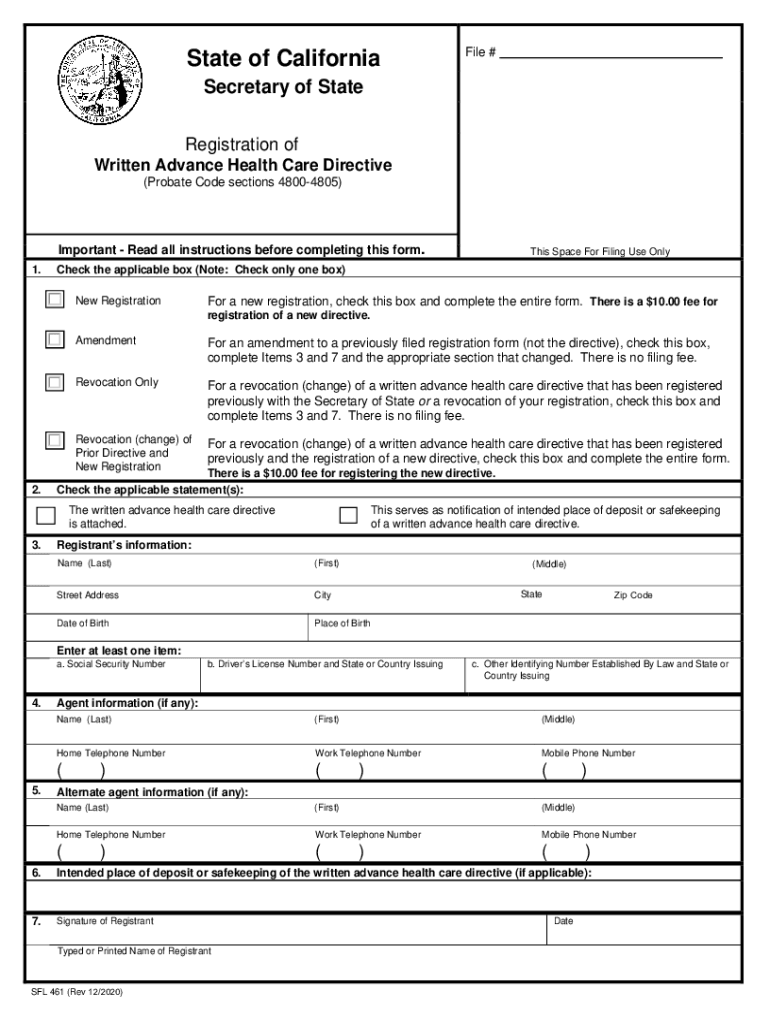

State of CaliforniaFile #Secretary of State Registration of Written Advance Health Care Directive (Probate Code sections 48004805)Important Read all instructions before completing this form. 1. This

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form sfl 2020-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form sfl 2020-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form sfl online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 461 directive. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

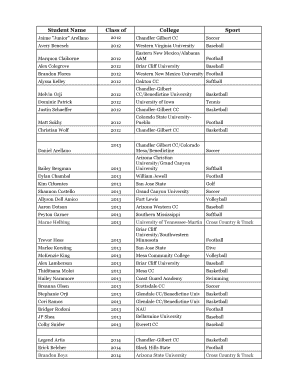

CA SFL-461 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form sfl 2020-2024

How to fill out form SFL:

01

Start by reading the instructions carefully to understand the purpose and requirements of form SFL.

02

Gather all the necessary information and documents that will be needed to complete the form accurately.

03

Begin by filling out the personal information section, including your name, address, and contact details.

04

Proceed to the specific sections of the form, such as employment history, educational background, or any other relevant information requested.

05

Provide accurate and detailed responses to each question or prompt, making sure to follow any formatting or formatting guidelines specified in the instructions.

06

Double-check all the entered information to ensure its accuracy and completeness.

07

If required, attach any supporting documents or evidence that may be necessary for the form.

08

Review the completed form one final time to ensure no errors or omissions.

09

Sign and date the form as required, and follow any additional submission instructions provided.

10

Submit the completed form SFL by the specified deadline or as instructed.

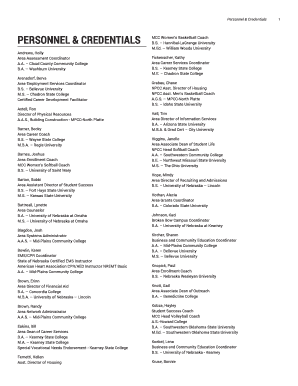

Who needs form SFL:

01

Individuals who are applying for a specific job, position, or program may be required to fill out form SFL as part of the application process.

02

Employers or institutions may request form SFL from applicants to gather relevant information about their qualifications, experience, or background.

03

The form may also be required for administrative purposes, such as record-keeping, auditing, or compliance with regulations.

Fill form written advance : Try Risk Free

People Also Ask about form sfl

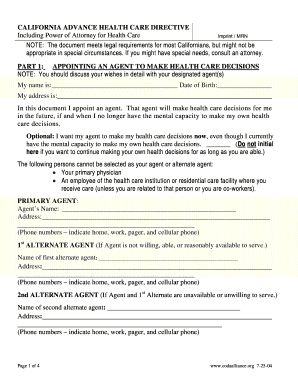

What is power of attorney in California for medical?

What is a medical power of attorney form in California?

Does a medical power of attorney need to be notarized in California?

What advance directive document is recognized in California?

Does an advance healthcare directive need to be notarized in California?

Where can I get an advance directive form in California?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form sfl?

There is no specific term or acronym "SFL" that is widely recognized or commonly used. It could be referring to something specific to a particular context or industry. Without more information, it is not possible to determine what "SFL" means.

Who is required to file form sfl?

The Form SFL is not a recognized form by the Internal Revenue Service (IRS) or any other relevant tax authority. Therefore, no individual or entity is required to file this form.

What is the purpose of form sfl?

There is not enough information provided to accurately determine the purpose of the specific form "sfl". Forms can have various purposes depending on the context and the organization using them. It would be helpful to obtain more information about the specific form or the context in which it is being used in order to provide a more precise answer.

What information must be reported on form sfl?

Form SFL, or the Schedule of Foreign Liabilities and Assets, is a reporting requirement for Indian residents who hold foreign assets or liabilities. The information that must be reported on Form SFL includes:

1. Identification details: The complete name, address, and Permanent Account Number (PAN) of the individual/entity holding the foreign assets/liabilities.

2. Nature and type of foreign assets/liabilities: The type of asset or liability being held, such as bank accounts, financial securities, immovable property, etc.

3. Country-wise details: Details of each foreign country where the assets/liabilities are held, including the name of the country and its International Organization for Standardization (ISO) alpha-2 country code.

4. Details of foreign currency: The amount of foreign currency held in each country and the conversion rate to Indian Rupees, along with the equivalent value in Indian Rupees.

5. Opening and closing balances: The opening and closing balances of foreign assets/liabilities for the reporting period.

6. Mode of holding: Whether the foreign assets/liabilities are held directly or indirectly through any intermediaries.

7. Loan details: If the foreign liability includes any loans, details such as the name of the lender, loan amount, purpose of the loan, interest rate, etc., need to be reported.

8. Compliance details: Any amendments or changes in the previously reported information for the relevant financial year.

It is important to note that the specific reporting requirements may vary depending on the type and nature of the assets/liabilities being held.

How do I execute form sfl online?

Filling out and eSigning form 461 directive is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the sfl 461 form electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an eSignature for the sfl 461 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your form sfl 461 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Fill out your form sfl 2020-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sfl 461 Form is not the form you're looking for?Search for another form here.

Keywords relevant to sfl461 form

Related to sfl 461 fillable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.